Are you going to run a business in the United States? In this case, we recommend you learn more about the US taxation system. So check what you should know about ecommerce sales tax in the USA to start and run a business on favorable terms.

In our previous article, we have discussed how to register a business in the United States, what the benefits of running a business in the US are, sorted out all the steps to get your venture started, and shared with you the secrets that can help you save time and money.

After you’ve registered your business, you need to learn how to deal with taxes. Today we’ll look into the whole issue of ecommerce sales tax in the USA. Whether you’re a US resident or not, the information provided in the article will be equally useful for everybody concerned.

Disclaimer: the article is for informational purposes only; Sellvia itself doesn’t provide legal advice and registration or taxation services.

What should you know about the US taxation system, and how much does a business owner have to pay in taxes?

We have already found out that registering a business in the United States is a great idea due to several benefits you get. After you’re finished with the process of registering your business, you need to study how the US taxation system works.

We suggest you go through a list of the most popular questions regarding taxation in the US. That will help you dispel myths and take you away from any fears related to running a business in the United States.

What is tax? What’s the difference between revenues and profit? [Tax glossary]

First of all, let’s figure out what tax is.

Tax is a payment or charge collected by the local, state, and national governments from entrepreneurs.

Taxes are mandatory payments governments have to levy to cover the costs of general government services, goods, and activities. There’re different taxes. What taxes concern you? There’re two kinds of taxes you should learn about: they are sales tax and income tax.

NB: Entrepreneurs in the USA pay taxes on their PROFIT only. Please don’t confuse these terms: revenue and profit.

Revenue is the amount of money you get from your customers after they buy from you; this sum is the whole price of your product including its initial price you pay to your supplier, the cost of marketing, shipping, packaging, etc.

Profit is the amount of money you can put in your pocket after deducting the product’s initial price, the cost of marketing, etc. For example, you sold a sofa for $3,000. This is your revenue. Then, you paid the supplier its initial price — $1,000. After that, you deduct the product price you pay to the supplier, the cost marketing and other expenses you experienced before you sold the product. For example, this is $1,500 that is your profit. This is the sum you’re going to pay taxes on.

What is the ecommerce sales tax, and how to deal with it?

Let’s start with the basics. If you run your business in the USA, it doesn’t matter if it’s a grocery or an online store, you need to collect a sales tax.

A sales tax is a consumption tax imposed by the government on the sale of goods and services. So if you sell goods or services, you’re supposed to collect a sales tax and pay the state you work in.

How much is the sales tax in the USA?

There’s no standard for the sales tax in the USA. The sales tax can vary depending on the state you work in. It ranges from 2.9 to 7.25 percent at the state level.

However, there are also exceptions to the rules. That’s why several states have a 0% sales tax, but they’re only five of them as of 2023. Here they come.

- Delaware, Montana, New Hampshire, Alaska, and Oregon.

How to collect the sales tax?

There are two options for you to collect the sales tax.

- You can include the sales tax in the product cost

Therefore, your potential customers will see a total product price without any additional notes.

- You divide the product cost and sales tax

In this case, your customers will see that they pay the sales tax each time they make a purchase.

Are there any other taxes you should take into consideration? [Solved]

Actually, there are two main types of taxes in the USA: Sales Tax and Income Tax. So let’s reveal the secrets behind income tax.

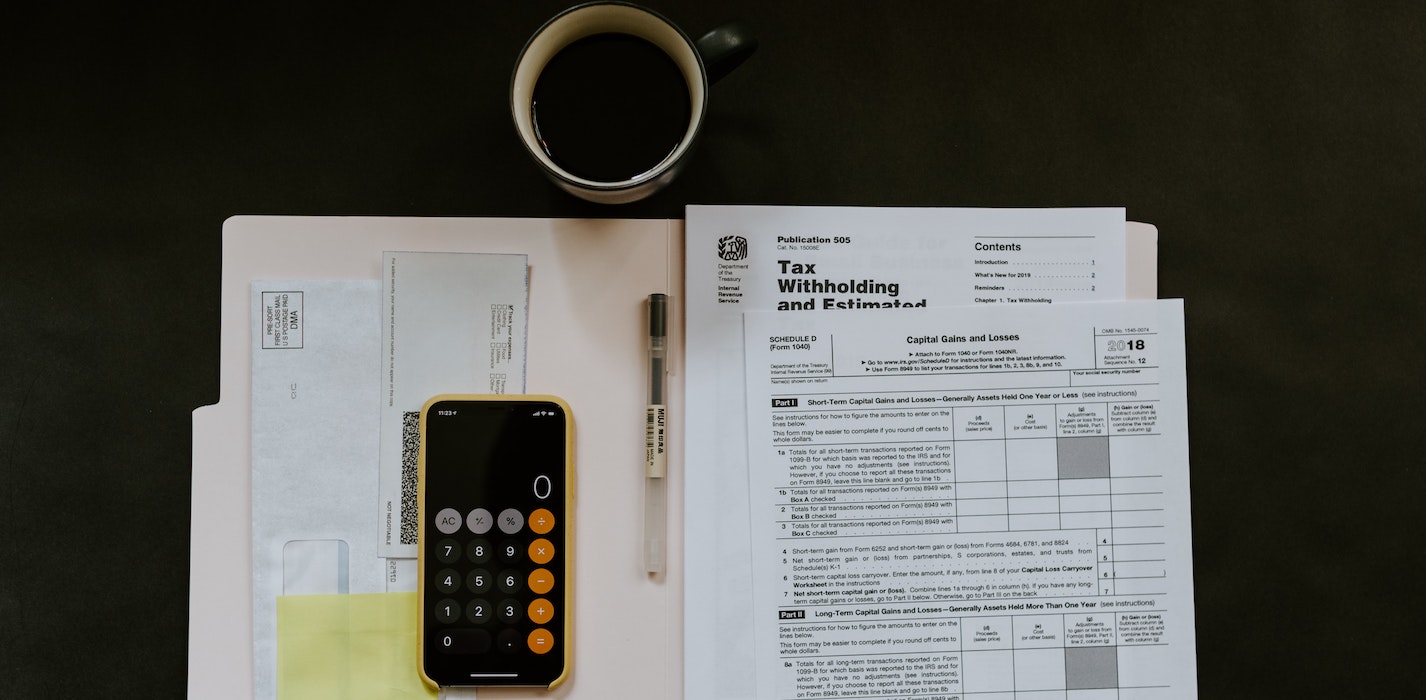

Income tax: basics

Remember, a dropshipper pays taxes on income only; revenues doesn’t matter here. You already know that you can avoid paying sales tax due to the states with 0% sales taxes. Other burdens are imposed on businesses with $100,000+ income in a state.

Income tax is levied on net income.

It is calculated with the help of the following formula: (Gross receipts from the business – all allowed business expenses) * Tax rate

How to calculate your income tax amount?

Let’s consider the example.

- So you sold a custom vacuum cleaner for $100. This sum is credited to your card, and this is your revenue.

- Now let’s run the numbers. You need to deduct all the expenses from this sum: the initial price of vacuum cleaner you paid your supplier, the cost of marketing, etc. (if there are some other expenses). Our cleaner cost me $30. Plus, we spend $10 on Facebook ads to drive a customer to our site and make it finish the order. $100-$30-$10=$60 of profit. We’ve registered a business in Montana and got a client for the same state. In Montana, there’s 0% sales tax, but there’s a 1-6.75% income tax. In our case, we must pay 2,1% of income tax — $1,26.

- How to get a net profit? $60-$1,26=$58,74. Congrats!

- How to pay taxes? When you’re ready to pay taxes, you submit a declaration according to your region’s law.

It is calculated on the basis of federal tax rates for a federal income tax return, state tax rates for state tax returns, and city rates for cities.

The three business-friendly states do not have Income tax requirements on the state level — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Every business entity is subject to Income Tax reporting requirements, with a few exceptions. These reporting requirements exist even if you do not have an income or even if you have a loss. Of course, you only have federal income tax reporting requirements if you have registered your business in the non-income tax state.

Businesses must file income tax returns on time regardless of the net income amount. Punishment for LLC’s late filing is simple — $195 per member for every month of delay up to 12 months. So, for two partners it could be up to $4,680 for one year delay. Corporation late filing penalties depend on the net income amount, and federal fines could be more moderate, but States usually hit hard following their state tax laws.

Should you register your business in each state you work in?

When we were speaking about starting a venture in the US, we recommended registering a business in the state with favorable taxation terms. It’s all about Delaware, Wyoming, Nevada.

❗However, according to US law, you have to register your business in each state you sell in.

Sounds intimidating, right? But let’s not panic ahead of time. This condition applies only to businesses with an income of more than $100,000 per month.

What are other tax limitations there in the US?

There’re, actually, some other aspects you should take into account when considering business taxation.

Economic nexus

What is the economic nexus?

Economic nexus implies that you have to collect sales tax in a state in case you earn above a sales or revenue threshold in that specific state.

It may seem too complicated, but there’s absolutely nothing challenging about it.

So if you’ve registered your business in, let’s say, Nevada, but you sell goods throughout the US, you need to carefully monitor your activities in each state.

First of all, you need to make sure that you haven’t reached a $100,000/month point in a state yet. If you have, congratulations! It means you’ve grown a really successful business. However, you’ll have to register your business in that very state. But it’s not a big deal.

Moreover, it’s necessary to check how many transactions you’ve in each state. If you don’t want to be subjected to economic nexus, there must be no more than 200 transactions a month in a state.

Physical presence nexus

All the states have a slightly different definition of nexus.

If we’re speaking about a physical presence nexus, it refers to your physical presence in a state (a warehouse, a headquarter, a brick-and-mortar store, etc.).

So if you have a warehouse that is full of products you sell, you will have to pay a tax for this in the state your warehouse is located.

Fortunately, if you’re going to start an online store, it doesn’t imply your physical presence in any state. This is why, with an ecommerce business, there’s no need to worry about the physical presence nexus.

Are there ways to automate the sales tax life cycle?

It becomes clear that if you run an ecommerce business in the USA, all you need to do to properly deal with the sales tax is to monitor a couple of aspects. However, in case you’re going to do this manually, it will take you time and effort that you’d better devote to the task requiring your particular participation.

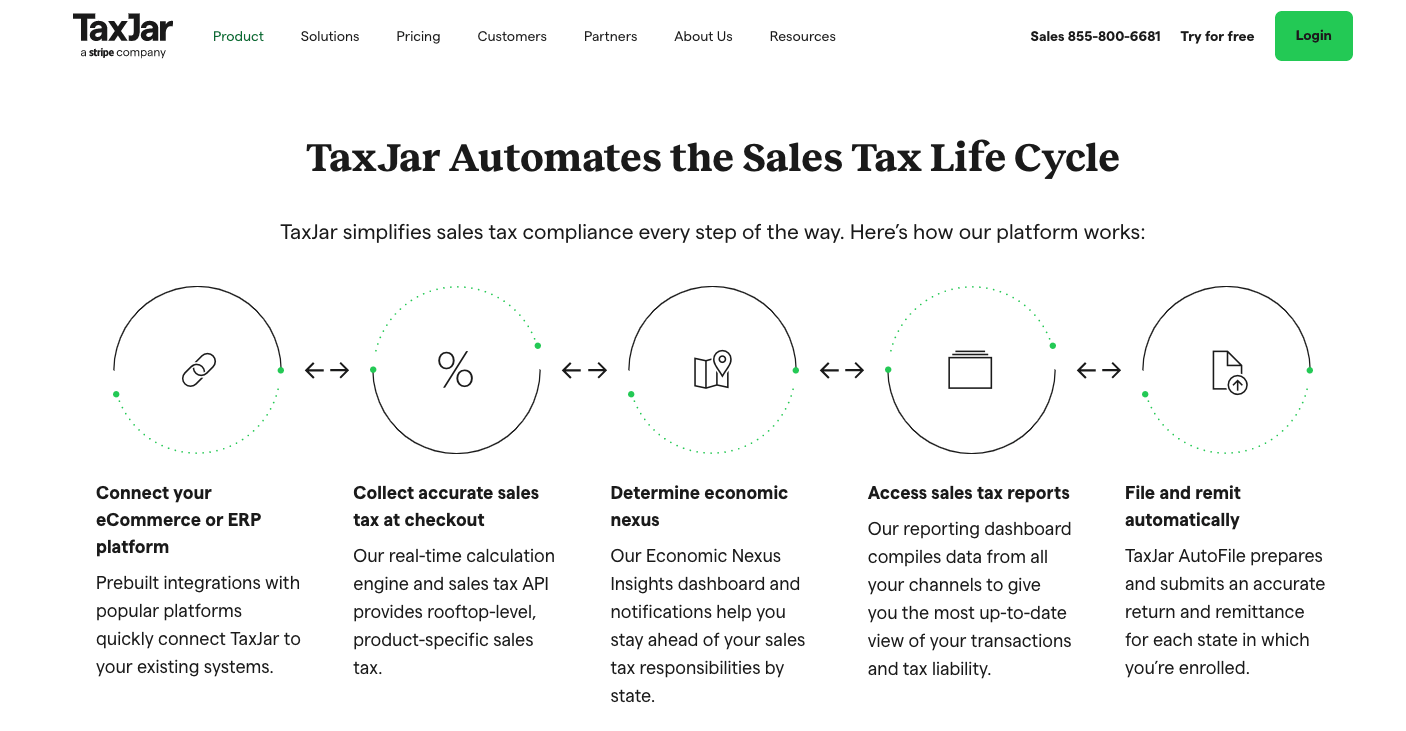

So are there any ways to automate the sales tax life cycle? In fact, there are some. One of them is TaxJar.

TaxJar was started to let you take care of a critical part of managing your business with no effort. TaxJar does the heavy lifting for you by automating your most tedious tasks. It accurately calculates sales tax rates, classifying products, and managing multi-state filing.

Due to the TaxJar dashboard, you will be able to see the states you have customers from, revenues, and the number of transactions in each state in real-time. Beyond the economic nexus, with TaxJar you can easily collect accurate sales taxes at checkout, access sales tax reports, file, and remit automatically, and so on.

Ecommerce sales tax in the USA: is this a reason for fear?

There is, actually, nothing scary and challenging about running a business in the United States. When you’ve already put your business on track, it remains for you only to collect the sales tax and monitor income and the number of transactions in each state.

Fortunately, there are tools for you to automate the sales tax life cycle. We recommend you consider using one of them. In this case, the process of managing a business registered in the US is not quite different from running a business in any other country.

Meanwhile, if you decide to register a business in the USA, you can rely on lots of benefits the US government is happy to provide small businesses with. As you can see, there’s no reason to be afraid of ecommerce sales tax in the USA.

So, start a business in the United States for free and make the most of your venture with Sellvia!

![Amazon FBA Is Dead: What's Next? [Best Alternative]](https://sellvia.com/wp-content/uploads/2023/12/cover_Amazon-FBA-is-evil-min.png)

![How Did Yuvy Get $77,000 With Just One Sale? It's High-Ticket Dropshipping [Case Study]](https://sellvia.com/wp-content/uploads/2023/12/image1-1.jpg)